You are now leaving the Strong Valley Wealth & Pension, LLC ("Strong Valley") website. By clicking on the "Schwab Alliance Access" link below you will be entering the Charles Schwab & Co., Inc. (“Schwab”) Website. Schwab is a registered broker-dealer, and is not affiliated with Strong Valley or any advisor(s) whose name(s) appears on this Website. Strong Valley is/are independently owned and operated. Schwab neither endorses nor recommends Strong Valley. Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with Strong Valley under which Schwab provides Strong Valley with services related to your account. Schwab does not review the Strong Valley website(s), and makes no representation regarding the content of the Website(s). The information contained in the Strong Valley website should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

Even though there is an ebb and flow of wealth accumulation in the stock market, trying to predict when those healthy returns might take place is almost impossible. In the meantime, there are lessons to be learned and research to be done that can lead to future opportunities.

The real value of a bear market may be that it gives investors, who are temporarily frozen within its grip, the opportunity to learn or relearn important lessons regarding risk and diversification. For savvy investors, a bear market also creates a period for looking beyond emotional headlines and studying the hard facts – facts that can ultimately place them in a position to take advantage of coming opportunities.

Periods of falling equity prices are a natural part of investing in the stock market. Bear markets follow bull markets, and vice versa. They are considered the “ebb and flow” of wealth accumulation.

Bear markets create apprehension in the minds of many people. That’s natural. However, any feelings of anxiety should be balanced with reason for anyone seeking financial success. Anyone dubious about the need for a stable outlook should consider that virtually every bear market was followed by a better than average annual rate of return from the bull market.

But just as importantly, bear markets have also at times delivered very healthy returns while the bear was on the prowl. And trying to predict when those healthy returns might take place is almost impossible.

Previous bear markets have delivered some very significant rallies. And while they did not predict the end of the bear’s reign, these rallies do provide good reasons to remain invested.

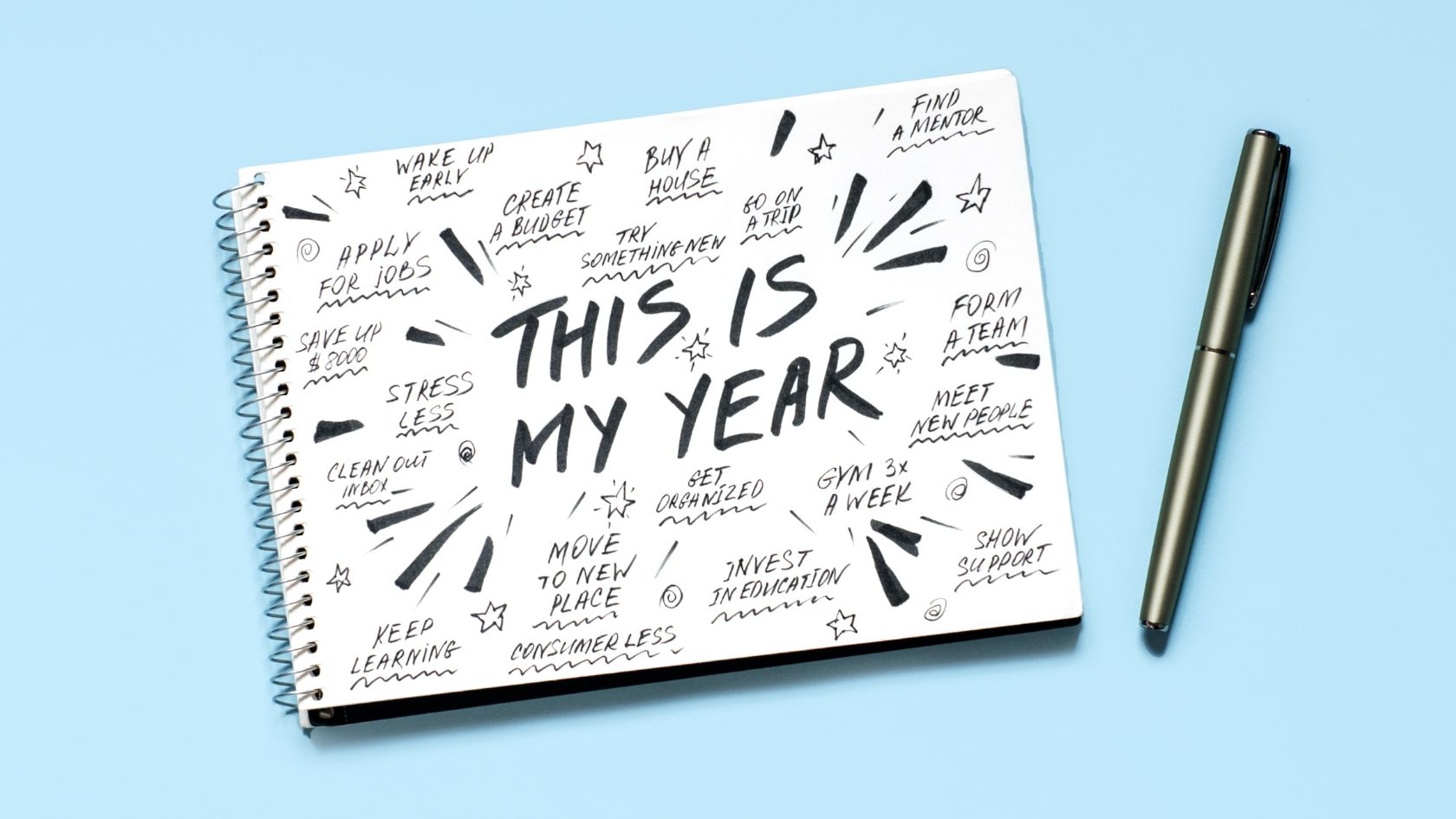

Instead of taking a “time out” from the market, and missing out on potential opportunities, investors should focus on five key lessons the market has repeatedly been trying to teach everyone during its naturally occurring economic cycles:

Remember that you’ll be inundated with all kinds of economic information during both bear and bull markets. There will be reports, for example, about inflation, interest rates, and unemployment figures that may entice you to either give up on the stock market or invest in it to the exclusion of investments paying relatively smaller returns. To avoid being lured to either extreme, develop a financial strategy with your financial advisor that accounts for risks you find comfortable.

Review your investments regularly to help ensure they are still relevant to your overall financial plan, and that you’re staying on track.

Then trust yourself and stick with your plan.