You are now leaving the Strong Valley Wealth & Pension, LLC ("Strong Valley") website. By clicking on the "Schwab Alliance Access" link below you will be entering the Charles Schwab & Co., Inc. (“Schwab”) Website. Schwab is a registered broker-dealer, and is not affiliated with Strong Valley or any advisor(s) whose name(s) appears on this Website. Strong Valley is/are independently owned and operated. Schwab neither endorses nor recommends Strong Valley. Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with Strong Valley under which Schwab provides Strong Valley with services related to your account. Schwab does not review the Strong Valley website(s), and makes no representation regarding the content of the Website(s). The information contained in the Strong Valley website should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

Why Use Securities for Charitable Giving?

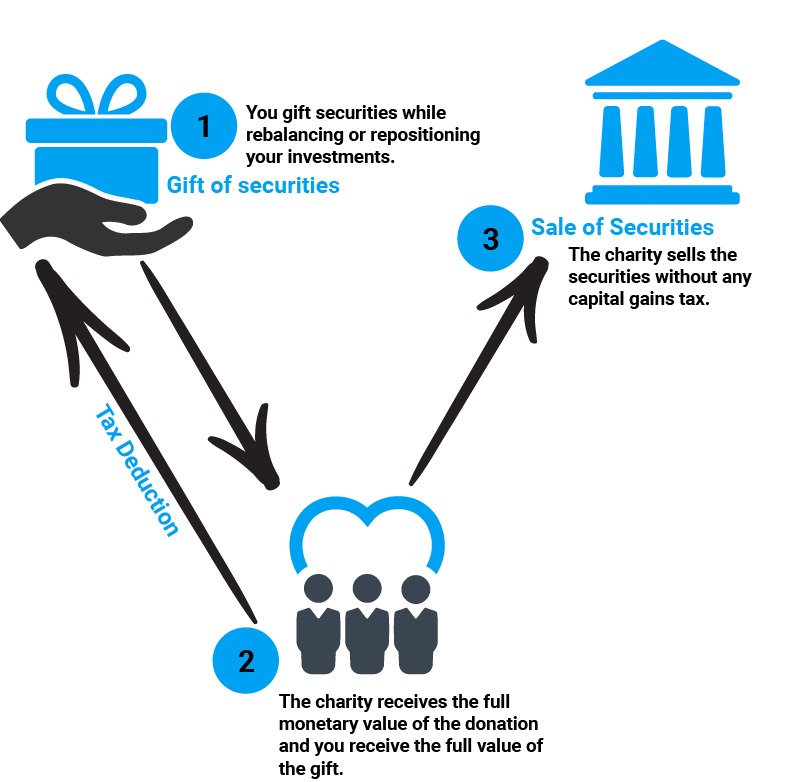

Using securities instead of cash can provide more benefits to both the charity and the donor. In fact, stock donations may represent 20% more financial value to the charity. This means that donors can give more money to the charity by donating securities instead of selling the same stock in order to make a cash donation, or worst of all just writing a check. And donors may also benefit from additional tax benefits and capital gains savings over charitable giving of cash alone.

There are some basic rules and guidelines, such as having held the appreciating stock for more than a year and ensuring that the transaction is received by the charity (not just started) by the end of the calendar year. Donors may be worried about the complexity, but the process can be much easier than donors may think. There are even donor-advised funds (DAF) that can allow you to make your contribution now in the current tax year, even if you haven’t yet decided on which charities to give to.

As your financial advisor, we can also help you decide which securities will make the most sense to donate. For example, selecting stocks as part of rebalancing your portfolio, or making a shift in your overall strategic investments. If you are considering charitable giving, now is the time to start those discussions so you can make the right decisions ahead of any end-of-year rush.

Tax-loss Selling & Capital Gains Reduction

Bottom-line financial performance for the year may often be less about earning more, and more about the ability to save and keep what you earn. One of the ways Strong Valley helps clients achieve better financial performance is by looking for opportunities to maximize savings and mitigating the tax burden and potential penalties from capital gains.

We look for tax losses within your security portfolio and replace those losses with equivalent security for at least 30 days. This allows you to record the loss for tax purposes while keeping your portfolio performance relatively unchanged. Up to $3,000 per year can then be written off towards earned income while keeping the rest for future tax years.

One capital gains example includes monitoring mutual funds in client accounts to see when those funds pay gains and determining if those gains are appropriate for the client’s situation. If not, then we can avoid unnecessary capital gains by selling the fund and moving to equivalent security for a short period before repurchasing the fund.

Maxing Out 401(k) / 403(b)’s For End-of-Year Contributions

We recently wrote another article about the new contribution limits for 2020 that covers some of the concepts and elements of maximizing your retirement contributions. In addition to maximizing any employer contributed matching, you may also want to make additional “catch-up” contributions to ensure that you take advantage of the total allowable savings deductions for the entire year. Of course, we will work closely with you to make sure those investments are allocated correctly, and to help you make decisions in line with your specific circumstances.

Business Profit Sharing Programs

If a business has a good year it may make sense to defer additional income by building up cash to prepare for a possible profit-sharing contribution plan. This is a completely discretionary decision, but it is one that could put more into your retirement account, and less into the hands of Uncle Sam. Profit-sharing plans can also be a great benefit for attracting and retaining employees – especially as unemployment numbers change and hiring becomes more competitive. Strong Valley can help business owners understand the options for structuring and maintaining a profit-sharing plan that can provide the most flexibility for your specific business. And probably, more importantly, provide advice on how to avoid some of the common pitfalls that can occur when a plan isn’t tailored correctly for your specific business and situation.